February 15, 2026 Newsletter

To receive these updates directly to your inbox, subscribe on Substack.

Recap of Housing Programs and Housing Bond Recommendation from Council Work Session

On February 10, 2026, Raleigh staff used a City Council work session to walk through a detailed presentation described as a “housing tools” toolbox with an interconnected set of policies and programs aimed at three headline goals: increasing the supply of affordable housing, improving overall housing affordability, and ending and preventing homelessness. The throughline of the presentation is practical: these tools are not presented as abstract concepts, but as building blocks that ultimately inform the City’s housing bond recommendations. (Slides 2–3, 65)

Missing Middle Housing

The work session begins by grounding the discussion in Raleigh’s most visible recent land-use change: Missing Middle housing. Staff shared implementation numbers through January 1, 2026—2,877 dwelling units approved, 961 units in review, and 870 units complete to show the scale of activity now moving through the pipeline. (Slide 6) The deck then reinforces the core argument behind supply-oriented policy: in markets where more housing was built, rents fell more sharply than in markets where little housing was built, drawing on a CoStar/Bloomberg reference. (Slide 7) The key takeaway is that the City is treating housing production as a key affordability strategy, not just a planning exercise. That raises the implicit question: whether the current policy framework is producing the types and locations of homes Raleigh needs or are further changes needed to reduce regulatory friction and speed delivery.

Homelessness is a Housing Problem

From there, the presentation makes an explicit link between housing costs and homelessness. It frames homelessness primarily as a housing-market problem: when rents are lower and more housing types are available, homelessness rates fall. When housing becomes scarce and expensive, homelessness rises. (Slide 8) That framing matters because it signals that homelessness policy cannot be separated from the broader housing agenda. It’s a reminder that visible homelessness is shaped by underlying economic factors driven by housing costs. It also points toward a paired strategy of near-term responses for unhoused people today and (2) longer-term actions designed to reduce housing instability.

Displacement

The middle of the deck focuses on displacement risk. Displacement is defined as relocation driven by rising costs, landlord pressure, or neighborhood change. The presentation organizes anti-displacement work into four buckets: Supply & Choice, Preservation, Targeted Investment, and Stability & Prevention. (Slide 10) The presentation then surveys ongoing efforts within each category and flags that some commonly discussed tools in other cities may not be available in Raleigh because the General Assembly (and Dillon’s Rule) restrict local government legal authority. For example, mandatory inclusionary zoning and rent stabilization are not legal in North Carolina. (Slides 12, 22–24) This section concludes by pointing to future tool ideas such as better displacement and risk monitoring, stronger eviction prevention coordination and streamlined access to housing resources. (Slides 25–26) Staff tries to position anti-displacement as part of an overall strategy that preserves existing affordability, prevents eviction and ensures new homes exist in enough places to reduce bidding wars. From a policy perspective, the issue largely relates to the scale and which households to prioritize, which geographic locations to focus on and how to fund the data and prevention infrastructure that makes the strategy durable.

Raleigh’s Affordable Housing Location Policy

A major portion of the presentation then turns to the question related to where affordable housing gets built in Raleigh. Staff explain that LIHTC projects are shaped heavily by land economics and scoring, including the role of Qualified Census Tracts (QCTs) and the “basis boost.” They note that because land is not included in eligible basis, higher land costs can be a particular constraint. (Slide 28) For projects that use City funding, staff describe Raleigh’s Affordable Housing Location Policy as a threshold requirement to receive City dollars intended to guide investment toward opportunity and prevent concentration while still acknowledging that land costs remain a primary driver. (Slide 29) The deck lists policy goals and exemptions, including categories like rehabilitation, senior/supportive housing, and proximity to frequent transit or future BRT. (Slide 30) Staff also explore the tradeoffs if the policy is tightened or frequently changed: per-unit costs can rise (reducing total units), limited land can slow development, and uncertainty can raise risk for developers. (Slide 31) This is the clearest explanation in the deck of the real-world tension between “building in higher-opportunity areas” and “building more units overall.” It also signals that location policy is not just a values statement, but also a production constraint or accelerator depending on how it is implemented.

Revolving Loan Fund and a Mixed-Income Housing Development Tool

The presentation introduces a new tool that helps finance new mixed-income housing using a revolving loan fund while also leveraging public ownership through the Raleigh Housing Authority. The model proposes to use City bond proceeds to capitalize a revolving loan fund that the Raleigh Housing Authority would use to help finance the construction of mixed-income, mixed-use development where roughly 30% of the units will be permanently affordable at ≤60% AMI. (Slides 33–36) The revolving loan fund is self-sustaining because loans paid back once a development is built and stabilized. Thereafter, the funds are used again for future projects. Public ownership is central (property tax exemption and ability reinvesting net income). That is why the model anticipates using development partners in a fee-for-service model with no ownership stake. (Slides 33–35, 40) It also notes local feasibility constraints, including the need for full public ownership to secure real estate tax exemption. (Slide 43) The key takeaway is that the mixed-income model is a long-term housing production platform, not a one-time subsidy. As Council considers the size of the next housing bond, it must decide whether to include funds to capitalize a revolving loan fund as part of a long-term affordable housing production strategy.

Moving YIGBY Forward

Another tool highlighted by staff is YIGBY (“Yes in God’s Backyard”), which involves working with faith communities to unlock sites for affordable housing. Staff identified 27 properties, with 13 expressing openness to affordable housing development. (Slide 47) The deck summarizes key findings (including the importance of education and that some congregations are seeking revenue through redevelopment) and lays out recommendations ranging from convening and technical assistance to possible process modifications and philanthropic leverage. (Slides 49–53) It also identifies Bloomberg Harvard initiative deliverables, such as site prioritization and a due diligence toolkit. (Slides 54–55) Implementing a YIGBY initiative might create opportunities for affordable housing in communities of opportunity where land is otherwise out of reach. For Council, the key question is whether (and how much) staff capacity the City should invest in such an effort.

Transitioning Raleigh’s Unsheltered Homelessness Pilot to the Wake Continuum of Care

The deck then returns to unsheltered homelessness with a description of a strategy published in January 2026 and developed with City, County, and community partners through a 53-member steering committee. (Slides 58–60) It describes a proof-of-concept effort providing rent assistance and case management to approximately 45 households, along with the goal of decommissioning one high-concern encampment while enrolling 45 unsheltered households. (Slides 58–59) The presentation also points to next steps focused on transitioning leadership/coordination of the concept to the Wake Continuum of Care, continuing implementation, and identifying funding beyond bond dollars to scale and sustain the work. (Slide 60) The presentation raises immediate questions for Council about program scale, governance, and the long-run funding model.

Preparing for a Housing Bond Referendum in 2026

Finally, the presentation ties these tools to a proposed 2026 housing bond. Staff recommend a $101.5 million bond, with allocations shown across housing development and preservation, mixed-income development, homebuyer assistance and preservation, and homelessness response. (Slides 65–66) The deck also offers an annual framing and associated production estimates under that approach. (Slides 67–68) Securing bond financing is the principal mechanism to implement and/or continue the City’s housing programs. Without additional bond funding, key housing programs will slow or need to wind down. To avoid this outcome, Council must develop an investment strategy based on Raleigh’s needs and priorities.

The 2025 State of Downtown Raleigh Report by the Downtown Raleigh Alliance

In the Last RaleighForward Newsletter, we summarized the 2026 Urban Land Institute Emerging Trends report. That report takes a broad look at real estate trends across the Country and a region-by-region analysis. The Downtown Raleigh Alliance issued its State of Downtown Raleigh Report recently. It has more timely data and information related specifically to Raleigh’s downtown. Here is a link to the full report and a few highlights:

The report documents sustained investment, rising residential growth, and major public and private projects that are reshaping Raleigh’s downtown. Since 2015, the downtown development pipeline totals $8.3 billion across completed, under-construction, and planned projects, with 5,970 residential units delivered over that period and the report noting the downtown residential population has doubled (reportp.2; p.1). The pipeline detail pages show the scale and geographic distribution of completed, active, and proposed projects that will define downtown’s near-term built environment (PDF p5; report pp.6–7).

The report says downtown currently has 15,681 residents (a 101% increase since 2015) and 10,426 housing units, with a projection of 8,681 additional residents by 2030 if planned growth materializes (PDF p.8; report pp.12–13). It also reports stabilized multifamily occupancy of 92.1% and highlights strong recent absorption (PDF p.8 and p.10; report pp.12–13 and pp.16–17).

On the commercial side, the report identifies downtown Raleigh’s Class A office direct vacancy rate at 14.1%, describing it as the lowest among major Triangle submarkets and comparing it favorably to peer markets (PDF p.2; report p.1). The report also summarizes downtown’s fiscal role, citing Wake County tax figures including $41 million in 2024 hotel occupancy taxes (with $8 million / 20% attributed to downtown) and $46.4 million in prepared food and beverage tax countywide (with $3.4 million / 7% attributed to downtown), and it references “over $62M annually” in combined property, hotel, and food & beverage tax revenue (PDF p.7; report pp.10–11).

Tourism and major civic projects are presented as core downtown drivers. The report highlights recent and planned hotel development and major planned facilities: a Convention Center expansion, Red Hat Amphitheater relocation/expansion, and a 600-room Omni convention hotel (PDF p.26; report pp.48–49). It lists project timelines indicating Red Hat’s new venue is planned for the 2027 season, the Omni for 2028, and the Convention Center expansion for 2029 (PDF p.27; report pp.50–51). The report also documents downtown activity levels, reporting 142 outdoor events from July 2024–June 2025 with 748,000+ attendees and noting 180+ pieces of public art downtown (PDF p.27; report pp.50–51).

In transportation and public space, the report notes 771 acres of greenspace within two miles of downtown’s center, including Dix Park and the Gipson Play Plaza (report p.28; pp.52–53). It describes underway and planned mobility projects, including construction of Raleigh’s first BRT segment along New Bern Avenue/Edenton Street between downtown and WakeMed as the first of four planned routes, and it cites a $1.09 billion federal grant (awarded in 2024) for the Raleigh to Richmond passenger rail (S-Line) project’s design, acquisition, and construction (PDF p.30; report pp.56–57). The report summarizes the City and partners’ Five-Year Downtown Economic Development Strategy and lists “10 big ideas” that include public realm, multimodal streets, small business support, and public space initiatives (PDF p.31; report pp.58–59). It also provides implementation examples such as a 2-hour free parking pilot in five city-owned decks, a Fayetteville Street streetscape design effort (including City Plaza concepts), and planning and improvements related to Moore Square and Nash Square, along with wayfinding initiatives (PDF p.35; report pp.66–67). The report additionally states that downtown streets are “dangerous by design” and calls for changes to right-of-way and multimodal connectivity (PDF p.33; report pp.62–63).

Action items identified in the report:

Track delivery of the downtown development pipeline (completed/under construction/planned) and regularly update infrastructure and service assumptions based on the pipeline map and phasing (PDF p.5; report pp.6–7).

Advance street safety and multimodal design changes in downtown corridors identified as hazardous, aligning capital projects and street standards with the report’s stated safety concerns (PDF p.33; report p.62–63).

Continue implementing plans for new/enhanced civic infrastructure (Fayetteville Street streetscape/City Plaza, Moore Square, Nash Square) with clear scopes, timelines, and performance measures (PDF .35; report pp.66–67).

Coordinate land use, curb management, and access planning around the Convention Center expansion, Red Hat relocation, and the Omni hotel to support event operations and visitor circulation (PDF p.26–27; report pp.48–51).

Monitor downtown housing indicators (units, occupancy, absorption, population projections) and incorporate them into near-term planning for public facilities and services (PDF p.8 and p.10; report pp.12–13 and pp.16–17).

Align transit project delivery and downtown planning with BRT construction phasing and future route planning and track major rail project milestones tied to the cited federal funding (PDF p.30; report pp.56–57).

Evaluate downtown parking and wayfinding pilots (e.g., free-parking pilot and wayfinding initiatives) using utilization and business/visitor metrics to determine whether to modify, expand, or sunset programs (PDF p.35; report pp.66–67).

Articles of interest this week:

This is a great video that breakdowns why it is so difficult to build new “starter” homes.

Congestion pricing in NYC and an unexpected beneficiary-suburban drivers.

Are YIMBY’s Winning the Housing War? Not so Fast, these People Say.

From the Data Department:

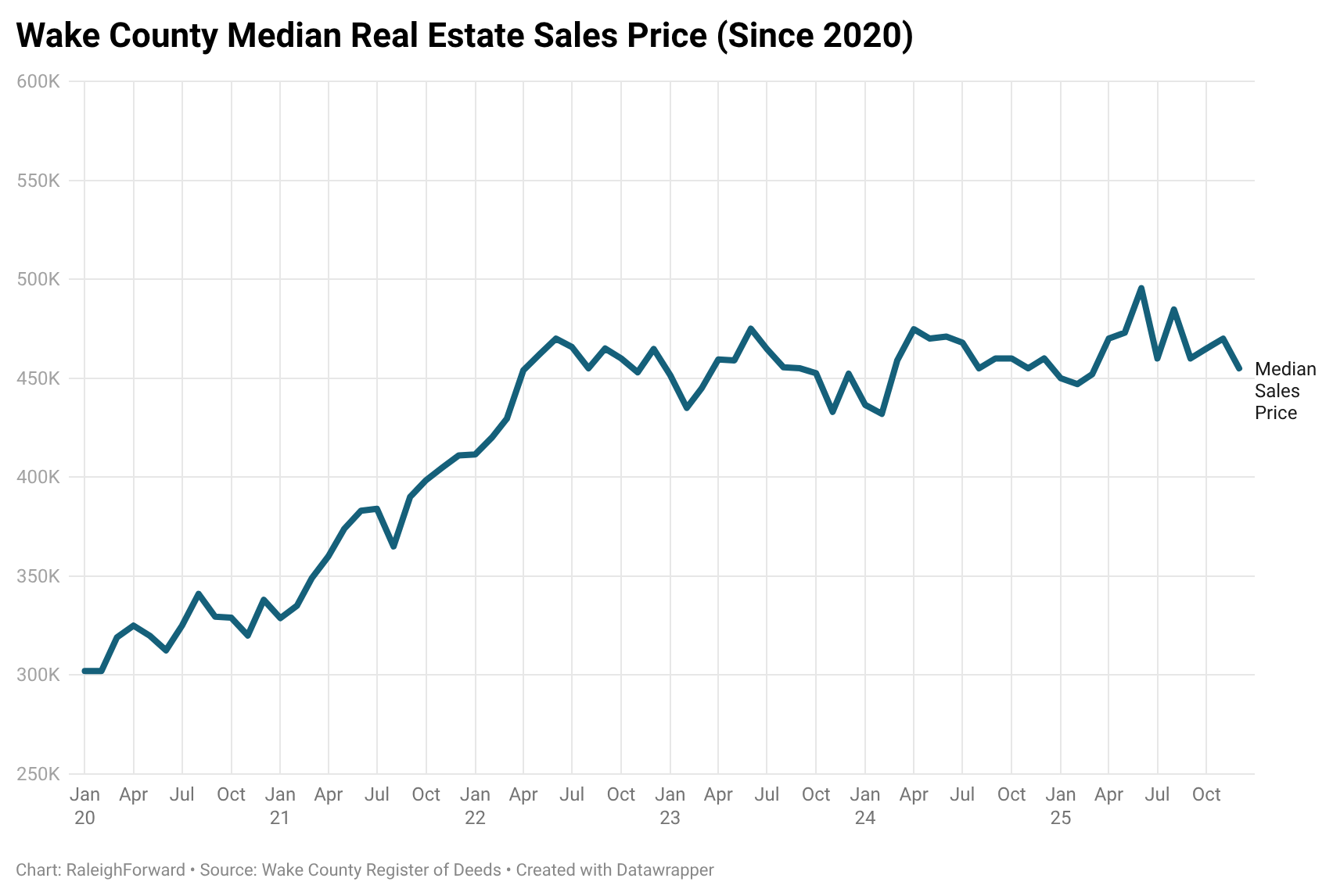

The January median price of Wake County real estate decreased by $5,000 to $450,000.

Raleigh City Council’s next meeting is February 17, 2026.

There are no zoning cases on the agenda, and it is a pretty light agenda overall.

One notable item is the cancellation of the regular work session scheduled for 11:30 because there is a joint City Council/County Commissioner work session starting at 6:00 pm on February 17. The purpose of the meeting is to receive information related to the work of the Wake Continuum of Care and the effort to address homelessness. There will also be information related to housing affordability and joint initiatives between the County and City. Click here for the agenda.

Other items of interest:

Council will conduct a “pre-budget” work session on Monday, February 16 at 4:00 pm.

Click here for the latest City Manager Report.